Personal Loans

Personal Loans

At ITR Mantra, we understand that life doesn't always go as planned—especially for hardworking

educators in the Teachers Self Care Team (TSCT). That’s why we offer quick and reliable personal

loans designed to provide instant cash when you need it most. Whether it’s rising medical bills,

urgent home repairs, or a postponed family event, our loan gives you the freedom to choose how

you use the funds.

Since it’s an unsecured loan, there’s no need to pledge your home, car, or any personal asset.

The application process is simple, with minimal documentation, and funds are disbursed quickly

so you can tackle your financial challenges without delay.

From unplanned emergencies to long-overdue vacations, our flexible loan solution is here to help

you move forward with peace of mind. At ITR Mantra, we’re committed to supporting teachers—not

just during tax season, but through every twist life brings.

Key features of ITR Mantra’s personal loan include:

No Collateral Required:

No property, no paperwork, no worry: the absence of collateral streamlines the entire experience and eliminates the usual back-and-forth. That single feature alone turns what can be a stressful ordeal into a considerably shorter errand.

Flexible Loan Amounts:

TSCT members may select an amount that matches their immediate gap rather than accept a one-size-fits-all figure. Whether the need is modest or sizable, the range of available brackets can be stretched to fit.

Competitive Interest Rates:

ITR Mantra also posts rates well inside the market average, so interest does not balloon after the first few months. That lower starting figure helps keep monthly outlays predictable even when other costs rise around it.

Convenient Repayment Terms:

Repayment schedules are elastic enough to accommodate a teacher's paycheck cycle, yet firm enough to keep the account from drifting. Borrowers sketch out a timeline that works for them and retain the option to hush the balance sooner without facing a penalty.

Quick and Easy Application Process:

The sign-up itself is designed for expediency, almost like opening a new bank app on your phone. Scans of a payslip, a government ID, and maybe one extra document often clear the underwriters in a day or two.

No Hidden Fees:

Finally, every figure on the loan estimate-both fees and charges-goes onto the first page of the disclosure. That upfront clarity spares members the sinking feeling that grows when surprise deductions show up on payday.

ITR Mantra has introduced a personal loan product specifically for teachers, underscoring the company's continuing pledge to alleviate financial pressure in the education sector. The offering is designed to cover unexpected bills while giving borrowers a real shot at long-term economic independence. Put another way, it aims to keep classroom professionals squarely in control of their money and their lives. An uncomplicated online application, paired with competitive repayment terms, lets members of the Telangana State College Teachers Association act quickly without second-guessing their decisions.

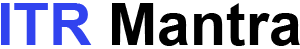

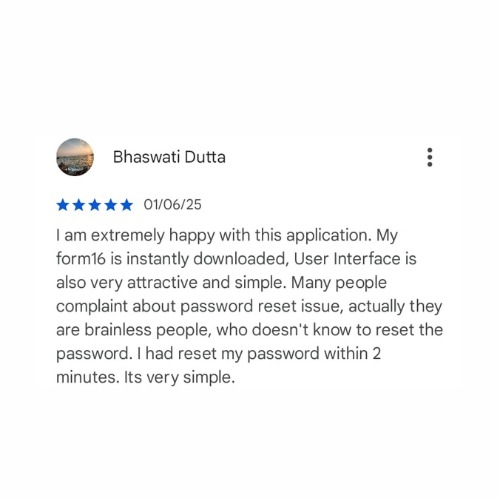

ITR Mantra APP Reviews

Frequently Asked Questions

Team Expert

Meet Our Advisory Team

Experienced professionals ensuring accuracy, compliance, and seamless tax solutions

kartikya Tiwari

Director

Indrani Sharma

CEO

Gaurav Pandey

Manager

Bhaswati Dutta

Team Leader

Ankit

Relationship Manager

Dilip Kumar

Relationship Manager

Harish

Relationship Manager

Harsh

Relationship Manager

Vinay Mishra

Relationship Manager