Cibil Improvement

ITR Mantra Offer Cibil Improvement Service For TSCT Members

At ITR Mantra, we acknowledge the significance associated with having a maximum credit score due

to its impacts on financial well-being. In line with supporting TSCT (Teachers Self Care Team)

members, we are happy to offer Credit Score Improvement Services so that educators can improve

their CIBIL score and their overall finances.

A healthy CIBIL score can benefit you whenever you are planning to apply for a loan or credit

card or finance management, CIBIL scoring plays a major factor on all of this. ITR Mantra aims

to assist TSCT teachers with the knowledge and expertise necessary to better their credit score

so they can access more financial services in a better manner.

Impact of CIBIL Score on Finances

Your CIBIL score is critical on your journey of managing finances. Financial bodies like banks

and others use CIBIL to check claims against them. You can benefit from having a high CIBIL

score since it leads to earlier loan approvals, more financial service options, favorable and

lower rate of interest. If you have a low CIBIL score, the chances of getting frustrated with

trying to access credit and getting a higher rate of interest increases significantly.

With our CIBIL improvement service, we teach TSCT teachers the importance of maintaining an

effective credit history and how they can strategically improve their score and the factors that

influence it.

Download web

What We Offer:

1. Personalized Guidance:

Get tailored advice aimed toward raising your CIBIL score.

2. Understanding Your Score:

Check your CIBIL score and interpretations of the score.

3. Effective Tips for Score Improvement:

Assured measures that will positively affect the score over time.

4. Ongoing Support:

Constant support to help you measure your achievements.

CIBIL Score Chart: From Good to Bad

| Cibil Score | Category | Loan Eligibility |

|---|---|---|

| 750 and above | Excellent | High Chances of approval with low interest rates |

| 700-749 | Good | Likely to be approved, but interest rate may vary |

| 650-699 | Fair | Approval possible but highest interest rates |

| 600-649 | Poor | Difficult to get approval, higher interest rates |

| Below 600 | Bad | High risk rejection, very high interest rate |

A CIBIL score above 750 is considered excellent, and is most beneficial when seeking loans; they can be obtained under very good conditions (low interest rates). Scores between 600-649 are deemed substandard which makes loans harder to get and at high rates.

Why strive to improve your CIBIL score?

Enhanced Loan Approval:

The core idea of any credit facility is to lend, therefore, chances of receiving a loan and credit card rise when scores go up.

Lower Interest Charges :

Big banks and lenders tend to be more favorable, processing loans at lower interest when scores rise.

Wider Financial Scopes :

A great score gives access to more financial services enabling better control of finances.

Take Charge of Your Financial Wellness.

Now, TSCT teachers can take control of their finances with ITR Mantra’s CIBIL Score Improvement Service. We will walk you through the entire process, helping you and your family work towards your financial goals. Register today to get this service and ITR Mantra will help you improve your CIBIL score!

Read in Hindi

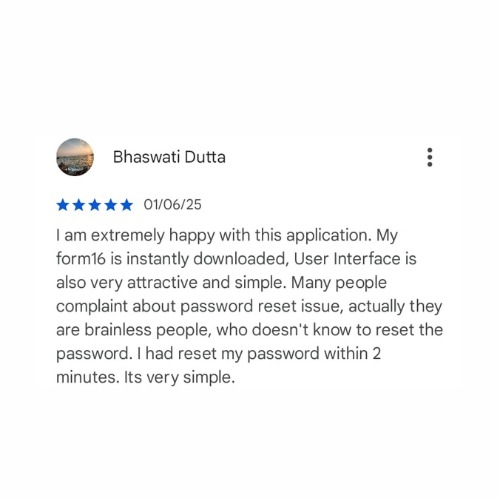

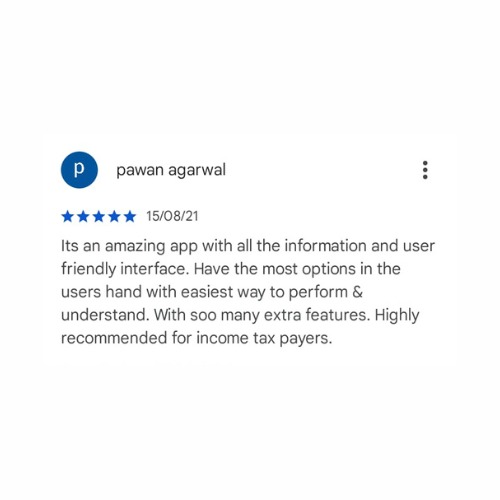

ITR Mantra APP Reviews

Frequently Asked Questions

Team Expert

Meet Our Advisory Team

Experienced professionals ensuring accuracy, compliance, and seamless tax solutions

kartikya Tiwari

Director

Indrani Sharma

CEO

Gaurav Pandey

Manager

Bhaswati Dutta

Team Leader

Ankit

Relationship Manager

Dilip Kumar

Relationship Manager

Harish

Relationship Manager

Harsh

Relationship Manager

Vinay Mishra

Relationship Manager