Income Tax Return (ITR)

Income Tax Return For TSCT

At ITR Mantra, we understand the challenges individuals face during tax season,

especially our dedicated teachers who give so much of themselves every day. That’s why

we’re proud to announce our newest partnership with the Teacher Self Care Team (TSCT),

offering exclusive Income Tax Return (ITR) services tailored specifically for TSCT

members.

This collaboration is designed to reduce the stress and complexity of

tax filing for educators, ensuring they get expert guidance, secure handling of personal

data, and timely filing — all at special rates. Our goal is to make tax filing simple,

efficient, and worry-free so teachers can focus on what truly matters: educating and

inspiring future generations. With personalized support from our experienced tax

professionals, TSCT members can now enjoy a seamless ITR filing experience from start to

finish. At ITR Mantra, we’re honored to support those who shape the minds of tomorrow.

ITR Package

ITR 1 (New Regime)

₹116.82

Base Price: ₹99.00

GST: ₹17.82

*Inclusive of GST

ITR 1 (Old Regime)

₹234.82

Base Price: ₹199.00

GST: ₹35.82

*Inclusive of GST

ITR 2

₹706.82

Base Price: ₹599.00

GST: ₹107.82

*Inclusive of GST

ITR Revised Return

₹706.82

Base Price: ₹599.00

GST: ₹107.82

*Inclusive of GST

Rectification of Mistake

₹706.82

Base Price: ₹599.00

GST: ₹107.82

*Inclusive of GST

Income Tax Notice Solution

₹1,178.82

Base Price: ₹999.00

GST: ₹179.82

*Inclusive of GST

ITR (Demand/Entice Reply)

₹1,178.82

Base Price: ₹999.00

GST: ₹179.82

*Inclusive of GST

ITR U Service

₹706.82

Base Price: ₹599.00

GST: ₹107.82

*Inclusive of GST

Why Choose ITR Mantra?

1. Expert Support

Tailored support for every IT return filing step by our adept tax experts.

2. Complete Services

Selection of right ITR form, tax saving strategies and filing your return accurately done by us.

3. Confidential & Secure

Client’s sensitive data during tax filing is private and secure.

4. Timely Filing Guarantee

We ensure your ITR is filed well before the deadline, helping you avoid penalties and last-minute stress.

Registration is Open

Claim the benefits of ITR filing services that are offered exclusively for TSCT members. ITR Mantra along with TSCT will ensure that your tax filing process is devoid of any complexities. Just follow the link below to register and commence with our streamlined processes.

Register Now so you can revel in our exclusive offerings while having your ITR filed seamlessly with the help of our seasoned professionals.

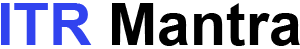

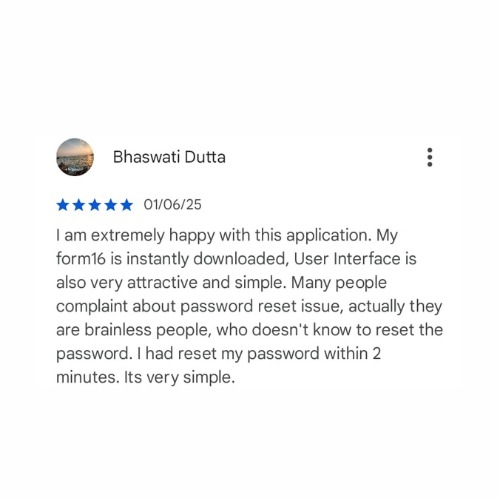

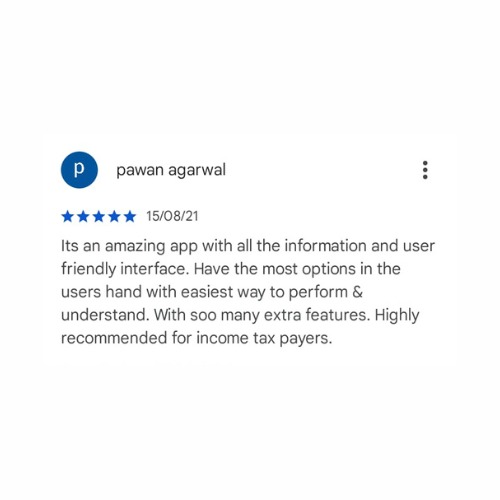

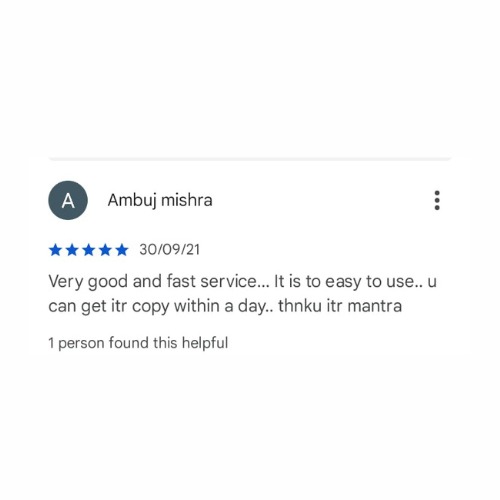

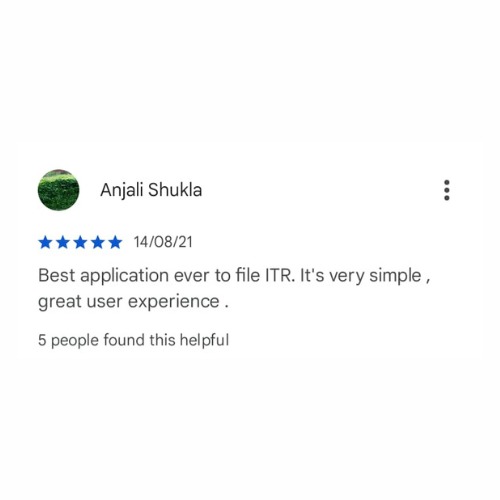

Register NowITR Mantra APP Reviews

Frequently Asked Questions

Team Expert

Meet Our Advisory Team

Experienced professionals ensuring accuracy, compliance, and seamless tax solutions

kartikya Tiwari

Director

Indrani Sharma

CEO

Gaurav Pandey

Manager

Bhaswati Dutta

Team Leader

Ankit

Relationship Manager

Dilip Kumar

Relationship Manager

Harish

Relationship Manager

Harsh

Relationship Manager

Vinay Mishra

Relationship Manager