Insurance

Insurance

ITR Mantra has announced a significant new move: it will start offering insurance service

specifically for members of the Teachers Self Care Team (TSCT). Under this program, TSCT

educators will be able to choose from a menu of plans designed with their everyday realities in

mind. Quality insurance stands out in any budget as a first line of defense against sudden

medical bills, accidents, or other unpredictable setbacks.

The project sits alongside the company's established tax-filing services, forming a one-stop

financial shop for busy teachers. Rates are being held within an affordable range so that even

early-career faculty can enroll without stress. Brokers on the ITR Mantra platform will walk

users through coverage details in plain language, not industry jargon.

Broader still, the launch signals the firm's ongoing promise to invest in the teaching

profession. By bundling tax help and now insurance under a single roof, ITR Mantra hopes to give

instructors a sturdier safety net and, ultimately, a calmer mind as they plan for tomorrow.

Insurance Type -

1. GENRAL INSURANCE

# Two Wheeler Insurance

# Four Wheeler Insurance

# Home Insurance

# Term Insurance

2. LIFE INSURANCE

Read in Hindi

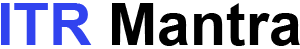

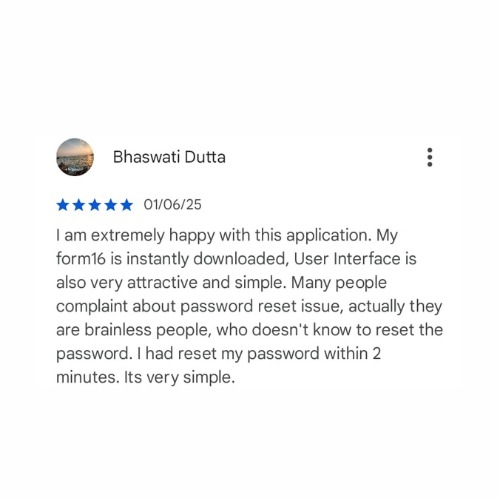

ITR Mantra APP Reviews

Frequently Asked Questions

Team Expert

Meet Our Advisory Team

Experienced professionals ensuring accuracy, compliance, and seamless tax solutions

kartikya Tiwari

Director

Indrani Sharma

CEO

Gaurav Pandey

Manager

Bhaswati Dutta

Team Leader

Ankit

Relationship Manager

Dilip Kumar

Relationship Manager

Harish

Relationship Manager

Harsh

Relationship Manager

Vinay Mishra

Relationship Manager