Investment

Investments

ITR Mantra is now offering a new range of investment options designed for TSCT (Teachers Self

Care Team) members that are both uncomplicated and diversified. In particular, these services

aim to assist teachers in financial wealth accumulation as well as achieving financial

independence.

These investment plans are curated keeping in mind the unique financial goals and risk tolerance

of educators. From safe fixed-income instruments to tax-saving mutual funds, ITR Mantra ensures

that every teacher can make informed decisions backed by expert guidance—building a secure and

stable financial future with ease.

Additionally, our platform offers personalized investment consultations to help teachers choose

the right portfolio based on their career stage, income level, and retirement goals. Whether you

are looking to build a long-term retirement corpus, save on taxes, or generate passive income,

ITR Mantra provides end-to-end support and complete transparency.

By partnering with reputed financial institutions and SEBI-registered advisors, ITR Mantra

ensures that all investment options meet compliance standards and offer consistent returns. Join

the growing TSCT community that’s taking charge of its financial journey—simple, smart, and

stress-free.

The following investment options are available:

Mutual Funds:

Pooling money from multiple investors and then investing it in multiple stocks, bonds, or other securities. Under the supervision of experts, mutual funds allow you to invest in a wide range of assets. For TSCT members seeking growth while managing risk, this investment option provides security and confidence in investment decisions.

Stocks:

Direct investments in the shares of companies. Stocks are riskier than other forms of investments; however, the potential return makes them very attractive. This potential return helps one dream of a great financial future, making it perfect for those willing to endure the market's twists and turns over time.

Bonds:

These are debt securities offered by governments or companies. Bonds are a less aggressive form of investment when compared to stocks. They provide periodic interest payments and the principal amount is returned at maturity.

Fixed Deposits (FDs):

Term deposits are a type of low-risk investment. In this case, a certain amount of money is deposited with a bank or financial institution for a certain period of time at a certain interest rate. Since term deposits offer a guaranteed return, they are ideal for conservative investors.

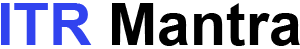

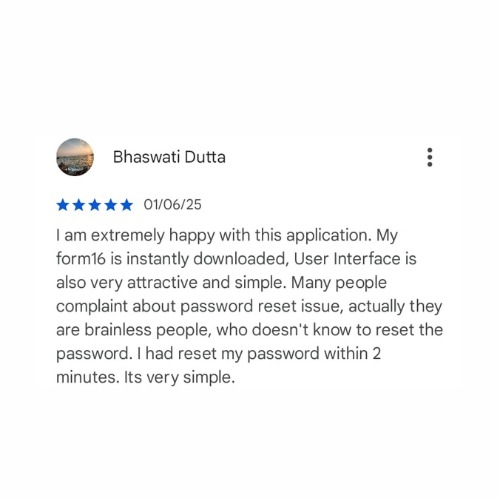

ITR Mantra APP Reviews

Frequently Asked Questions

Team Expert

Meet Our Advisory Team

Experienced professionals ensuring accuracy, compliance, and seamless tax solutions

kartikya Tiwari

Director

Indrani Sharma

CEO

Gaurav Pandey

Manager

Bhaswati Dutta

Team Leader

Ankit

Relationship Manager

Dilip Kumar

Relationship Manager

Harish

Relationship Manager

Harsh

Relationship Manager

Vinay Mishra

Relationship Manager