Loans

Loans

Teachers rack up expenses just like anyone else, so ITR Mantra has rolled out a fresh set of

loan products aimed squarely at them. The idea is simple:

give members of the Teachers

Self

Care Team the cash support they need to smooth out life, level up their careers, or put down

roots in a new home. Every loan is built with the understand-ing that teachers' budgets can

shift day to day and require a little extra room to breathe.

The loan services include the following types:

Personal Loan:

First up is the personal loan. Because it comes unsecured, there is no stack of paperwork proving ownership of a sofa, bike, or piece of land. The money can jump toward an unplanned hospital bill, foot the tab for a classroom trip, or finish that long-dormant house project- you call the shots and pay it back in far smaller steps than the average credit card.

Car Loan:

If four wheels are more your style, the car loan will catch your eye. ITR Mantra pairs competitive rates with terms that wont gobble half your paycheck, helping TSCT members slide behind the wheel of a fresh sedan or trusty hatchback without losing sleep over the monthly bill.

Two-Wheeler Loan:

If the roar of a motorcycle engine or the hum of a scooter engine pulls you forward, ITR Mantra can back that instinct with cash. Quick credit, friendly interest, and a timetable the average teacher can actually pencil in let you buy the wheels first and worry about the monthly statement later.

House Loan:

Buying the chilly first flat or finally moving out of the rented box toward a house of your own, the same outfit makes sure the price tag loses some of its menace. Long repayment stretches, trimmed rates, and the unmistakable promise that home-purchase jitters won't sink the deal half-way through.

ITR Mantra doesn't just lure TSCT members with numbers; it hands them the practical means to park a motorcycle in the hallway or hang a set of keys by the front door. Custom terms, competitive figures, and an application that doesn't ask for three lifetimes of paperwork keep the whole thing human rather than bureaucratic.

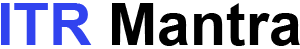

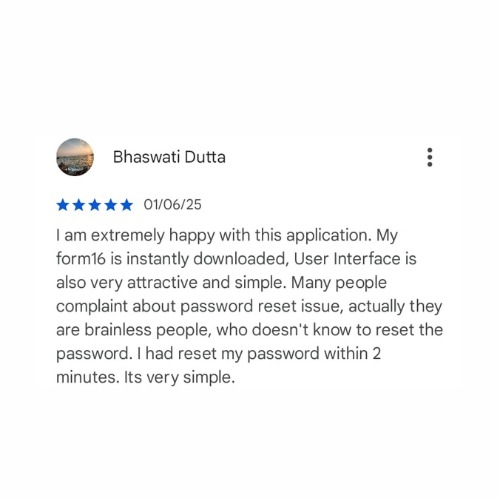

ITR Mantra APP Reviews

Frequently Asked Questions

Team Expert

Meet Our Advisory Team

Experienced professionals ensuring accuracy, compliance, and seamless tax solutions

kartikya Tiwari

Director

Indrani Sharma

CEO

Gaurav Pandey

Manager

Bhaswati Dutta

Team Leader

Ankit

Relationship Manager

Dilip Kumar

Relationship Manager

Harish

Relationship Manager

Harsh

Relationship Manager

Vinay Mishra

Relationship Manager